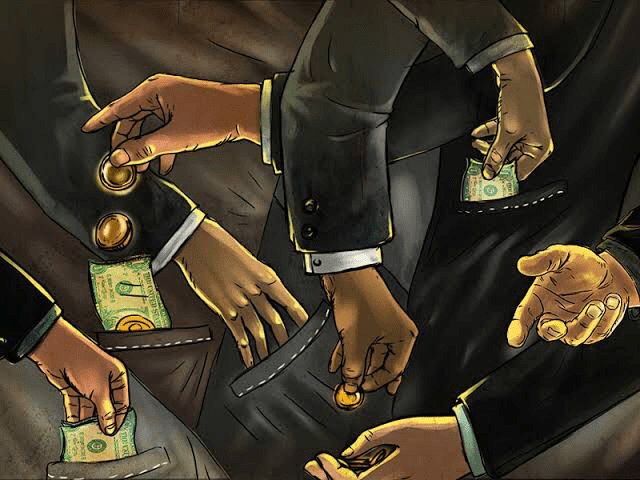

Legalities and open letters aside, this matter affects the entire local financing ecosystem and has far reaching consequences in access to finance.

After years of brewing, legal battles between Vantage Capital and Mr. Patrick Bitature’s Simba Group concerning an initially USD 10million loan are now public knowledge.

Commercial lawyers are having a field day in court, filing one suit after another, and making argument upon argument.

As all of this plays out, our society should not ignore the fact that this suit affects the entire local financing ecosystem and deepens the social and economic inequalities that many organisations have worked to address.

Our country is not short of entrepreneurs, ideas, labour, or opportunities. But none of these can come to fruition without tailored and relevant business financing. While access to capital remains the biggest hindrance to business growth, the cost of borrowing continues to rise.

Borrowing costs not only include interest (which is calculated based on the risk rating of the borrower, business venture, and collateral, etc), but further include due diligence and legal fees, security perfection and in some cases, feasibility studies.

Interest rates average at 16%, collateral requirements range from 1.2X loan amount, due diligence, legal and arrangement fees can exceed 5% of the amounts borrowed. Borrowing costs as it stands are already prohibitive, and only privileged businesses can access timely financing.

Precedence set by the Vantage Mezzanine Fund II Partnership vs Simba Properties Investment Company Limited and Ham Enterprises Limited vs Diamond Trust Bank (Uganda and Kenya) Limited, does one thing very effectively – increase the risk rating of Uganda as an investment destination causing some investors to shy away completely from doing business in Uganda, or allowing those who remain brave enough to tighten borrowing requirements.

Stringent borrowing requirements and high borrowing costs increase the access to finance gap, leaving small businesses and women owned businesses farther behind.

Many may read glorious stories of start-ups raising funding and think that it is easy to launch a business and find some investor to fund it. Far from it. If anything, Uganda has quite the number of disillusioned entrepreneurs who thought they would turn into an overnight success. Over 60% of the businesses in Uganda fail to make it to their 5th anniversary, as compared to 24% in Kenya and 33% in Nigeria.

To borrow Mr. Bitature’s words, entrepreneurship requires integrity, hard work, grit, and determination. Building a sustainable business is not easy and in Uganda, it is a lot more difficult.

Although African start-ups raised over $4billion in 2021, 62% flowed to fintechs, leaving more traditional business models scrambling for the remainders, most of which flowed to Nigeria-$1.37bn; South Africa-$838m; Egypt-$588m; and Kenya-$3375m, whose start-ups received over 80% of the funds raised.

Less than 1% of funds raised flowed to Ugandan businesses. These inequalities are more alarming when funding to smaller businesses and women owned businesses is considered.

For Ugandan businesses to access foreign capital, due diligence costs will be higher and, in more cases, local entities with external holding companies will be preferred borrowers.

Some sections of our society could think that they are unaffected by this, but in truth, we are all affected. The risk premium on lending in Uganda is already volatile and worsened by these cases, and more practically speaking, we live in an inter-connected economy fed from the same source through different channels. Every large enterprise needs sustainable financing and goes on to not only employ people directly but is serviced by multiple other SMEs. Take for example the security company, fresh food suppliers, alcohol distributors, cleaners, laundromats, etc, who thrive within the Simba Group.

If big businesses fail, small business suffer.

What we therefore need to be doing – legalities aside – is build our market and businesses to be more investable, ready to access capital, deploy it responsibly and pay it back profitably.

Our entrepreneurial generation needs business leaders who share more on how to build a scalable business sustainably. Many a first-time entrepreneur is shocked and ready to quit at the first challenge, because we glorify material success and learn very little about what it takes to succeed ethically.

The more disappointing issue about the Simba Group saga is that economies thrive through growth of locally owned companies – for one simple reason, there are more locals than foreigners, who therefore ought to be supported to build sustainable businesses. But finding credit worthy locals is increasingly the cry of every regional fund manager and investment readiness program.

It is comforting to read that the Central Bank and other agencies are taking this matter seriously and will hopefully increase efforts to ensure that Uganda’s risk profile is managed, and more local businesses are not disadvantaged by these cases.